How do I enroll in Digital Banking?

You can easily enroll in our Digital Banking by clicking the "Enroll Now" link below the login on the homepage.

What happens if I forget my Digital Banking Password?

You are allowed 3 attempts to enter your password. If unsuccessful after the 3rd attempt, you will be locked out.

You can select the "forgot" link on the login screen to reset your password. You will be given an option to key in your username and email address or you can click the "Try Another Way" link and input your social security number and account number.

What is 2-Step Verification?

2-Step Verification is a form of multifactor authentication that adds an extra layer of security to your digital banking. Each time you sign into your account on an unrecognized device, we require your password and a verification code. This code should never be shared with anyone.

What Banking Transactions Can I Perform with Digital Banking?

Digital Banking allows you to manage your accounts and banking transactions more closely and it gives you greater control over balances, bill payments and deposits:

View information about your account balances and transactions.

Transfer funds between your deposit accounts.

Transfer funds to make your loan payment.

Pay bills to virtually anyone in the United States.

Message Customer Service Representatives for information on products and services.

Download transactions from Digital Banking into other financial management software such as Quicken and Quickbooks®

Make mobile check deposits using the "My WSB" app.

How do I add an account(s) to an existing online ID?

What happens if I lose my mobile device?

What are the fees associated with Bill Pay?

Once enrolled in bill pay, after 12 months of inactivity, you will be assessed a $5.00 monthly inactivity fee. If you no longer would like to use the service at that time, you can submit a message through the digital banking message center to unenroll.

How does the Bill Pay service work?

Your payments are either electronically transferred from your Watertown Savings Bank checking account through the Automated Clearing House (ACH) network or checks are written from your account and then mailed to the payee.

How are online payments delivered?

Payments are sent one of two ways—electronically or by paper checks. The majority of payments are delivered electronically. Your payment information, such as your account number, is sent via secure transmission. All other payments are made by paper checks that are mailed via the U.S. Postal Service.Is Online Bill Pay secure?

Paying bills online is one of the safest ways to pay your bills. Online Bill Pay helps guard against identity theft from lost or stolen checkbooks, bills and statements. It also increases your privacy because only you can access your account information, account numbers and payment history. As a result, you maintain tighter control of your account with real-time access to your payments activity.How long does it take before my payment is received?

Payments made with the Bill Payment Service require sufficient time for the Payee to credit your account properly. We recommend you select a payment date for electronic payments at least three (3) business days before the payee’s payment due date to ensure the payment is received on time. For payments being made by check, you should establish the payment date at least ten (10) business days prior to the payment due date. Saturdays, Sundays and holidays are not considered business days.When will the money be taken out of my account?

Electronic payments are deducted from your account on the payment date. Payments made by check will be deducted from your account when the draft reaches our bank, the same as if you had written the check yourself.

How late in the day can I enter, edit, or delete a payment?

Bill Payments are processed at 3:00 pm est. on the scheduled payment date. Payments requested after 3:00 p.m. est. will be initiated on the next business day. Saturdays, Sundays and holidays are not considered business days.

Can I use Bill Payment if I live outside the United States?

Yes, as long as you have a bank account in the United States. However, you cannot pay bills to payees located outside the United States.

How long is Bill Payment history retained for?

Payment History is retained for 18 months.

Can I use Digital Banking to Pay My Existing Watertown Savings Bank Loans, Line of Credit and Mortgage Payments?

Absolutely, and with Digital Banking, you can get your Watertown Savings Bank payments paid faster! Simply transfer funds from one of your Watertown Savings Bank accounts (checking, savings, etc.) to the account you wish to pay. You don't even need to utilize the Bill Payment function to pay Watertown Savings Bank bills. Transferring funds will get your Watertown Savings Bank loans and lines paid faster!

What if I Make a Payment to the Wrong Payee? Can I Cancel or Stop the Payment?

If you scheduled a payment to be processed immediately, you may not be able to stop the payment. Any other scheduled or recurring payments may be canceled if done within one business day before the process date. For additional information contact us during regular business hours at (315)836-8450.

What is Gift Pay?

Gift Pay allows you to send donations to charities and gift checks to individuals for special occasions. These payments are draft checks. The funds are not withdrawn from your account until the the payee cashes the check.

Are there transaction limits?

Yes, they are as follows:

Bill payment to a business is limited to no more than $50,000.00 per day.Bill payments to an individual may not be more than $3,000.00 per item, and a total of $6,000.00 per day.

What is Mobile Deposit?

Mobile Deposit allows you to deposit checks using the camera on your mobile phone or tablet. Using the My WSB App.

How many deposits can I make in a day and how much can I deposit?

Consumer Customers – Your daily deposit limit is $2,500.00 and up to 10 items per day. Monthly deposit limit is $10,000.00 and up to 20 items per month.

Business Customers - You will be auto-enrolled in the free plan shown below.

Plan 1: Free – Daily deposit limit is $2,500.00 and up to 10 items per day. Monthly deposit limit is $10,000.00 and up to 25 items per month.

Plan 2: $25.00 – Daily deposit limit is $4,000.00 and up to 10 items per day. Monthly Deposit limit is $10,000.00 and up to 50 items per month.

Plan 3: $37.50 – Daily deposit limit is $6,000.00 and up to 15 items per day. Monthly Deposit limit is $15,000.00 and up to 75 items per month.

Plan 4: $50.00 – Daily deposit limit is $8,000.00 and up to 20 items per day. Monthly Deposit limit is $20,000.00 and up to 100 items per month.

Can I increase the amount that I am allowed to deposit in a day/month?

Yes, you may request an increase by sending a message through the digital banking message center.

How long do I need to keep the original check for?

You must securely store the original Check for 14 days after your deposit and make the original Check accessible to us at our request. Promptly after the 14 day retention period expires, you must destroy the original Check by first marking it “VOID” and then destroying it by cross-cut shredding or another commercially acceptable means of destruction.

How do I endorse the check?

Each check should be endorsed as follows “For Mobile Deposit Only, Watertown Savings Bank account # ____________, and the Payees Signature(s)”. Endorsements must be made on the back of the share draft or check within 1 ½ inches from the top edge. For a check payable to you and any joint owner(s) of your bank account, the check must be endorsed by all such payees. For a check payable to you or your joint owner, either of you can endorse the check. Please Note: If the check is payable to you and any non-joint owner, you may not deposit the check into your Bank account using this service.

When will the deposit be made to my account?

Accepted Mobile Deposits will be reflected in accounts at approximately 8:30 am, 12:30 pm and 4:30 pm on business days. Based on the time of your deposit, it will be made available to you in the next sequential time frame listed above. Deposits made on non-business days will be available on the next business day at approximately 8:30 am.

Can I deposit a check drawn off from a Foreign Financial Institution?

Checks drawn off from a Foreign Financial Institution with a Foreign Routing Number will not be accepted for deposit. These checks must be deposited at one of our Branch Offices.

What if I make a mistake when making my deposit?

If you make a mistake entering the amount of the deposit, you will receive an email informing you of the adjustment. If you do not receive an email and your account is credited for the incorrect amount, please contact us at 315-836-8450 or send a message through the digital banking message center, immediately. We reserve the right to reject any item transmitted through this service, at our discretion, without liability to you. Any items rejected may not be re-deposited through Digital Banking, you may present the item to one of our Branch Offices for review and deposit.

What accounts can I deposit into?

We have selected certain accounts to be available to deposit into. If these are not the correct accounts or you would like additional accounts added please send a message through the digital banking message center.

Do I need to use a deposit slip to make a deposit through Mobile Deposit?

No, we will use what is called a substitute (or electronic) deposit slip to post the deposit to your account. You will only need to take a picture of the front and back of the check being deposited.

Can I deposit my check into more than one account?

No, you can only deposit your check into one account. The next business day you can log into your Mobile Banking and transfer funds.

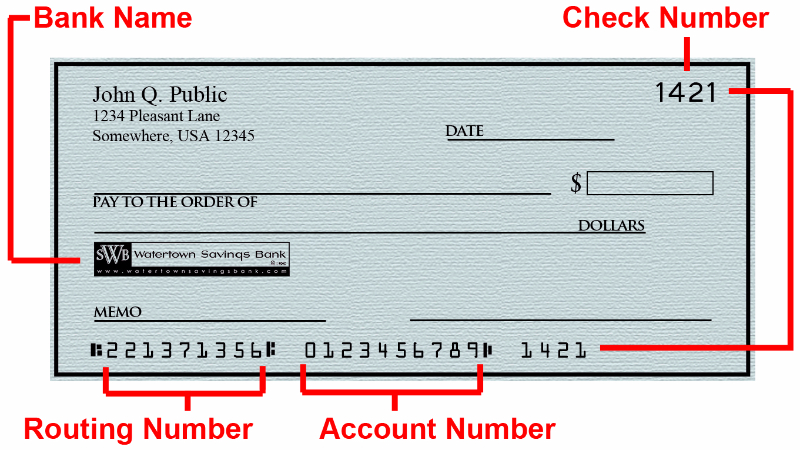

Where do I find the routing number for the Bank and my account number?

What information do I need to either send or receive a wire transfer?

We offer a variety of wire transfer services. You can select the wire transfer form that fits your needs by visiting the Forms Library of our website and clicking on the "Customer Service Forms" tab.

What is the difference between a Wire Transfer and a Bank to Bank Transfer?

A Wire Transfer is an electronic transfer of funds across a network administered by hundreds of banks around the world. Wire transfers allow for individualized transfer of funds from single individuals or entities to other individuals or entities, while still maintaining efficiencies of fast and secure movement of funds. Wires most likely provide the quickest availability of funds. The fee for outgoing domestic wire transfers is $20.00 and the fee for international wire transfers is $45.00. Most receiving banks apply fees to incoming wires. International wire transfers may have additional fees from a correspondent bank for conversion of funds. A Bank to Bank Transfer is a transfer setup through digital banking between your personal account at Watertown Savings Bank and your personal account at another financial institution. This type of transfer is not available for business customers. The transfer is processed through the ACH network and typically takes less than 3 days. There is a $3.00 fee for outgoing transfers and incoming transfers are free. Bank to bank transfers are not available for international bank accounts.

How do I sign up for Direct Deposit?

To sign up for direct deposit of Social Security you may either contact the Social Security Administration office or feel free to visit any one of our locations and we would be happy to assist you. To sign up for an employer direct deposit you will need to speak with your employer and provide them with the Banks routing number (221371356) and your account number. You can visit the Forms Library of our website and select the "Direct Deposit Forms" tab.to choose and download the Direct Deposit form that fits your needs.

Do you offer accounts where two signatures are required?

We do not offer accounts on which two signatures are required for a check or other withdrawal. Notwithstanding any provisions to the contrary on any signature card or other agreement you have with us, you agree that if any account purports to require two or more signers on items drawn on the account, such a provision is solely for your internal control purposes and is not binding on us. If more than one person is authorized to write checks or draw items on your account, you agree that we can honor checks signed by any authorized signer, even if there are two or more lines on the items for your signature and two signatures are required

Do I have to come into the bank to open an account?

Yes, In order to open an account with Watertown Savings Bank you must be present, and you must provide your personal identifying information, such as, physical address, date of birth, social security or EIN number, and contact information prior to the account being opened.

Do I have to come into the bank to change the title on my account?

Yes, changing the title on the account requires documents to be signed by an individual that is currently on the account as well as anyone that may be added to the account.

What is a Bank to Bank Transfer?

Bank to Bank Transfer allows you to transfer funds between eligible Watertown Savings Bank accounts and your accounts at other financial institutions through digital banking.

How long does it take?

Once your ownership of the external accounts has been established, transfers typically take less than 3 to 4 days.

What is the maximum I can transfer?

There is a $25,000 limit for incoming transfers per business day and a $4,000 limit for outgoing transfers per business day regardless of the number of accounts you are using.

What is the cost to transfer funds?

Transfers to your Watertown Savings Bank accounts from another financial institution are free. A $3.00 fee will be assessed for each transfer you make from your Watertown Savings Bank account to your accounts at another financial institution.

Are there limitations on the accounts you can use for transfers?

In order for you to use your accounts at other financial institutions, Watertown Savings Bank must verify you are authorized on the account.

What is the difference between a Bank to Bank Transfer and a Wire Transfer?

A Bank to Bank Transfer is a transfer setup through online banking between your personal account at Watertown Savings Bank and your personal account at another financial institution. This type of transfer is not available for business customers. The transfer is processed through the ACH network and typically takes less than 3 days. There is a $3.00 fee for outgoing transfers and incoming transfers are free. Bank to bank transfers are not available for international bank accounts. A Wire Transfer is an electronic transfer of funds across a network administered by hundreds of banks around the world. Wire transfers allow for individualized transfer of funds from single individuals or entities to other individuals or entities, while still maintaining efficiencies of fast and secure movement of funds. Wires most likely provide the quickest availability of funds. The fee for outgoing domestic wire transfers is $20.00 and the fee for international wire transfers is $45.00. Most receiving banks apply fees to incoming wires. International wire transfers may have additional fees from a correspondent bank for conversion of funds.

How does Watertown Savings Bank verify my account?

In order for you to use the account at the other financial institution, Watertown Savings Bank must verify that you are authorized on the account. This will be accomplished by crediting your external account with a random deposit amount within one or two business days. Once you see the credit on the external account, log back into Internet Banking, go to enrolled accounts and key in the amount of the credit without decimal points or dollar signs. For example, if 10 cents is credited to your external account, you will enter 10 in the verification field. You will have 7 days to complete this process. .

Can I set up recurring external transfers?

Yes, you can schedule one-time and recurring external transfers.

Is there a limit to the number of external accounts I can have set up?

You are limited to 2 accounts from other financial institutions.

Will there be a hold on my incoming funds?

Yes, funds will not be available for 2 business days after the day of the transfer. This typically will make your funds available to you in 3 business days.

How do I use the contactless feature on my card?

First, look for the contactless ![]() symbol on the payment terminal at the pump or check-out line. Then simply tap your contactless card on the terminal to make your payment. Wait for payment confirmation and that’s it.

symbol on the payment terminal at the pump or check-out line. Then simply tap your contactless card on the terminal to make your payment. Wait for payment confirmation and that’s it.

What if a merchant’s terminal does not accept contactless payments? Will my card still work?

Yes. Insert the EMV card or swipe the magnetic stripe like you would have done with your previous card. Online purchases work the same as with your previous card.

How can I tell if a card or payment terminal accepts contactless payments?

Both the card and the terminal will have the contactless symbol noted.

Can I use the contactless functionality for all my purchases?

Contactless payment availability may vary depending on terminal enablement, merchant preferences, transaction location or purchase amount. You may also be asked for your signature or PIN in some cases.

Does my chip card work at the ATM?

Yes. You can still use your card to get cash, check your balance and more.

Where can I use my contactless card?

Use your contactless EMV chip card at the same places you do now. Tap or insert your card at EMV enabled terminals or swipe your card at terminals that have not yet switched. You can use your card as you did before for online payments, telephone payments and at ATMs.